Malaysia’s e-Invoicing journey is reshaping how businesses handle tax reporting, documentation, and compliance. The Inland Revenue Board of Malaysia (IRBM), also known as Lembaga Hasil Dalam Negeri (LHDN), is moving all businesses toward digital invoicing under a phased rollout plan that runs until 2026.

For many Malaysian companies, understanding what the e-Invoice mandate means, when it applies, and how to get ready can feel overwhelming. This guide breaks down the Malaysia e-Invoice implementation timeline and shows how Boyang Consultancy Services SND. BHD. Odoo e-Invoicing solution helps businesses achieve smooth, stress-free compliance.

What Is Malaysia’s e-Invoicing System?

Malaysia’s e-Invoicing system is part of the government’s national digital transformation plan. Instead of issuing paper or PDF invoices, businesses will create standardized, electronic invoices that are validated in real time through the MyInvois system, a platform managed by LHDN.

Every e-invoice is securely stored and verified through this centralized system, allowing transparent, error-free reporting. This ensures tax accuracy and helps businesses operate more efficiently.

With mandatory e-Invoicing rolling out between 2024 and 2026, it’s vital for companies to ensure their ERP systems, such as Odoo, are fully integrated with MyInvois.

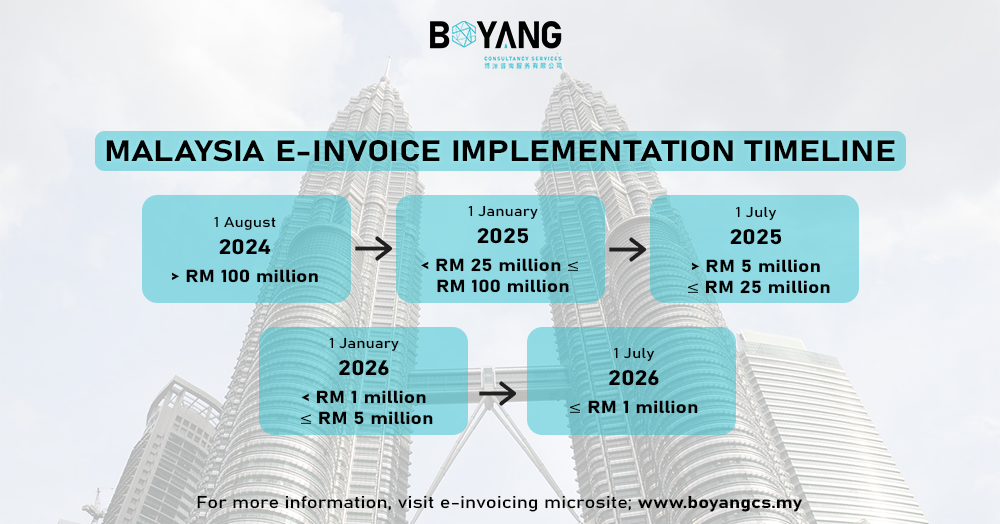

Malaysia e-Invoice Rollout Timeline (2024–2026)

The IRBM has announced a phased implementation plan based on business turnover. Here’s how it’s structured:

Phase 1: Large Companies

-

Who: Businesses with annual turnover above RM100 million

-

Voluntary Start: August 1, 2024

-

Mandatory Compliance: February 1, 2025

Phase 2: Mid-Sized Companies

-

Who: Turnover between RM25 million and RM100 million

-

Voluntary Start: January 1, 2025

-

Mandatory Compliance: July 1, 2025

Phase 3: Small and Medium Enterprises (SMEs)

-

Who: Turnover between RM500,000 and RM25 million

-

Voluntary Start: July 1, 2025

-

Mandatory Compliance: February 1, 2026

Phase 4: Remaining Businesses

-

Who: Turnover between RM150,000 and RM500,000

-

Mandatory Compliance: July 1, 2026

Businesses with annual turnover below RM150,000 are currently exempt from mandatory e-Invoicing.

The Six-Month Relaxation Period Explained

Each e-Invoicing phase includes a six-month relaxation period, designed to help businesses transition smoothly without immediate penalties.

During this period:

-

You can issue consolidated e-Invoices for B2B and B2C transactions.

-

Product and service descriptions can be kept flexible.

-

No fines are imposed under Section 120 of the Income Tax Act 1967.

This grace period is the perfect time to test your systems, train your staff, and fix any technical issues before full compliance is enforced.

What Businesses Should Do in Each Phase?

Phase 1: Large Enterprises, Full Compliance by February 2025

If your business falls under Phase 1, you must already be preparing for full e-Invoicing adoption. Key steps include:

-

Validating all B2B transactions individually.

-

Ensuring invoice data matches LHDN’s e-Invoice schema.

-

Automating invoice workflows within your ERP.

-

Testing and cleaning historical data before live rollout.

A robust ERP like Odoo can automate most of these tasks while ensuring your invoices meet every technical requirement.

Phase 2: Mid-Sized Businesses, Get Ready by July 2025

Companies with turnover between RM25 million and RM100 million should start early.

Recommended actions include:

-

Conducting a full ERP system gap analysis.

-

Integrating Odoo ERP with MyInvois via API.

-

Running pilot tests for high-volume transactions.

-

Training employees on validation workflows and error resolution.

During the voluntary period, you can still upload invoices manually via the MyInvois portal, but once the mandatory date arrives, API integration becomes essential for efficiency.

Phase 3: SMEs – Prepare for February 2026

For SMEs, 2025 is the year to start preparing.

Checklist for readiness:

-

Register for the MyInvois Sandbox by April 30, 2025.

-

Clean and digitize your supplier and customer data.

-

Choose between a middleware solution or full Odoo integration.

-

Automate recurring invoices to save time and avoid human errors.

Proper preparation helps SMEs avoid last-minute technical issues and ensures smooth day-to-day operations once compliance is mandatory.

Phase 4: Small Businesses – July 2026 Adoption

Even if your business turnover is below RM500,000, it’s smart to start planning now.

Here’s what you should do:

-

Analyze whether a portal-based or API-based solution fits your business size.

-

Digitize all records to ensure accuracy.

-

Avoid manual entry wherever possible—automation saves effort and reduces risk.

With an easy-to-use ERP like Odoo, even small businesses can handle e-Invoicing with confidence.

Penalties for Non-Compliance

Once the e-Invoicing deadlines begin, non-compliance can lead to serious consequences under the Income Tax Act 1967.

Businesses may face:

-

Fines ranging from RM200 to RM20,000 per offense.

-

Imprisonment up to six months, or both.

Even minor errors such as incorrect formats, missing Unique Identification Numbers (UINs), or late submissions can result in penalties. Early integration is the safest and most cost-effective solution.

Why Choose Boyang Consultancy Services for e-Invoicing Implementation?

Onnet Consulting is one of Malaysia’s leading Odoo Gold Partners, helping companies digitize and streamline operations. Our team specializes in LHDN-compliant e-Invoicing implementation, ensuring your ERP system is fully ready for all phases of Malaysia’s e-Invoice rollout.

With Onnet Consulting, you get:

-

End-to-end Odoo ERP integration with MyInvois API.

-

Seamless management of B2B, B2C, and self-billing transactions.

-

Real-time e-Invoice validation and tracking.

-

Compatibility with POS, e-commerce, and accounting systems.

-

Scalable setup for multi-branch and multi-company operations.

We handle everything, from initial gap analysis and testing to complete go-live support—so your business stays compliant without workflow disruptions.

How Boyang Consultancy Services Simplifies Your e-Invoicing?

Our e-Invoicing solution is designed to remove complexity from the process. Here’s how we make it easier for you:

-

System Assessment: We evaluate your current ERP setup and identify what’s missing.

-

Odoo Customization: We configure Odoo ERP to match your invoicing structure and LHDN requirements.

-

API Integration: We connect your Odoo system to MyInvois for instant validation and submission.

-

Testing & Training: We help your team test real transactions and train them to handle errors efficiently.

-

Post-Go-Live Support: Continuous assistance to ensure your system runs smoothly with every update.

By combining technical expertise with local compliance knowledge, we ensure your transition is quick, smooth, and fully compliant.

Prepare Your Business Today!

The e-Invoice mandate is not optional. Businesses that start preparation early will save time, avoid penalties, and gain a competitive advantage through automation and efficiency. With Boyang Consultancy Services Odoo e-Invoicing solution, you can comply confidently while focusing on what truly matters—growing your business.

Get ready now. Contact us today for a free e-Invoicing consultation or product demo, and see how easily your business can meet Malaysia’s e-Invoice requirements.